With recent legislation nicknamed the “Big Beautiful Bill” (BBB), more Americans may finally see some relief when it comes to the cost of borrowing — especially when financing a vehicle.

If you’re thinking about buying a car in 2025, this bill could mean more savings in your pocket — especially if you’re planning to finance your next vehicle instead of paying all cash.

Here’s what’s in the bill, how it helps buyers, and why financing (even if you have the cash) might now be the better financial move.

💼 What Is the Big Beautiful Bill?

While the official name is longer, this new legislation — affectionately dubbed the “Big Beautiful Bill” — includes several tax relief measures and consumer finance updates designed to:

- Encourage responsible borrowing

- Support middle-class car buyers

- Offset rising interest rates with tax incentives

One key feature: a new federal tax deduction for interest paid on qualified auto loans, similar to how mortgage interest works.

💸 How This Helps You as a Car Buyer

Here’s how the BBB can potentially save you money:

- ✅ Tax Break on Interest: If you finance your car, you may now be able to deduct the interest you pay from your federal income taxes — a first for many car buyers.

- ✅ Smarter Cash Management: Instead of tying up your savings in a vehicle, financing lets you keep your money earning interest elsewhere or reserved for emergencies.

- ✅ Lower Effective Borrowing Cost: Even if your loan rate is 6% or 7%, the tax deduction could reduce your real cost of borrowing to something closer to 4% or less.

- ✅ Improved Monthly Budgeting: Financing breaks the cost into manageable payments — a big plus in today’s economy, where flexibility matters.

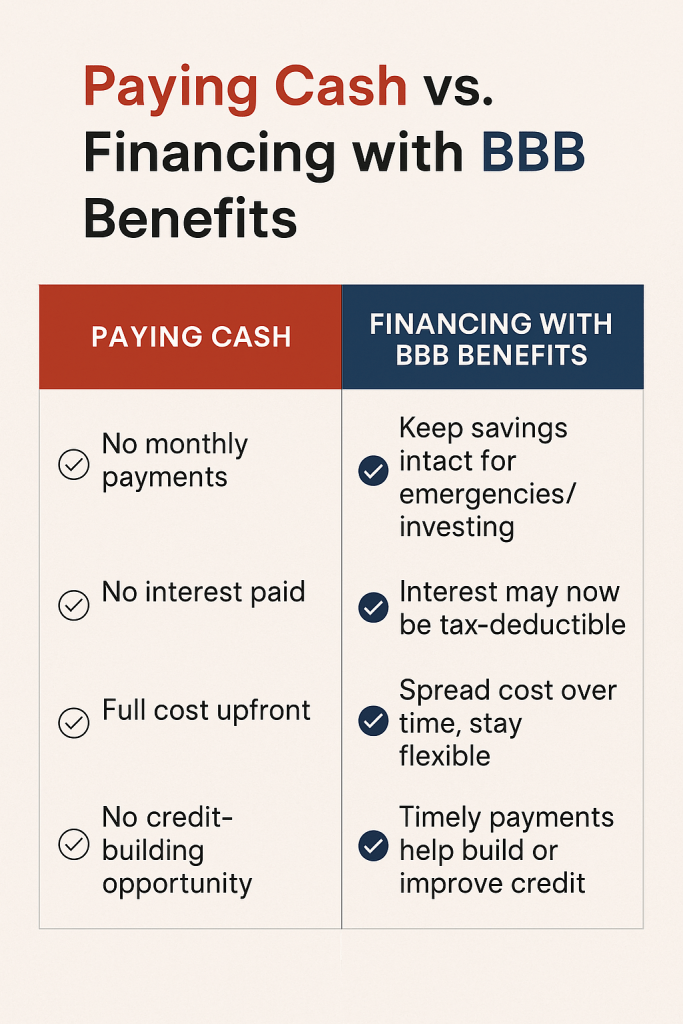

🤔 Should You Still Pay Cash?

It’s a personal choice, but with this new tax incentive, here’s why financing may be the smarter strategy for many:

Unless you’re getting no loan approval or a high interest rate, financing gives you more control and may cost you less in the long run — especially with the BBB tax break factored in.

🧮 Quick Example:

Let’s say you finance $30,000 at 7% over 5 years:

- Interest over the loan = approx. $5,600

- With a 22% tax bracket, your deduction could save you $1,200+ in taxes

- Your real cost of borrowing? Much lower than the sticker rate

Now imagine using that $30K in savings for a down payment on a house, investing in a high-yield savings account, or keeping your rainy-day fund safe.

🛻 What This Means for Your Next Vehicle

At Apple Ford of Lynchburg, we’re keeping a close eye on all the ways policy changes affect our customers — and this one could be a game changer. If you’re shopping for a car and wondering what’s the smartest financial move, I’m here to help you break it all down.

Let’s look at the big picture — not just the price tag.

📞 Call: 434-423-0235

📧 jgrove@applefordva.com

🌐 www.applefordva.com

Leave a comment