Remember when used-car pricing soared during pandemic shortages? While the market has mostly stabilized, savvy shoppers still need data—and strategy—to get the best deal. Let’s dive into the latest U.S. trends and why being informed matters now more than ever.

📊 1. Used Car Prices & Market Trends

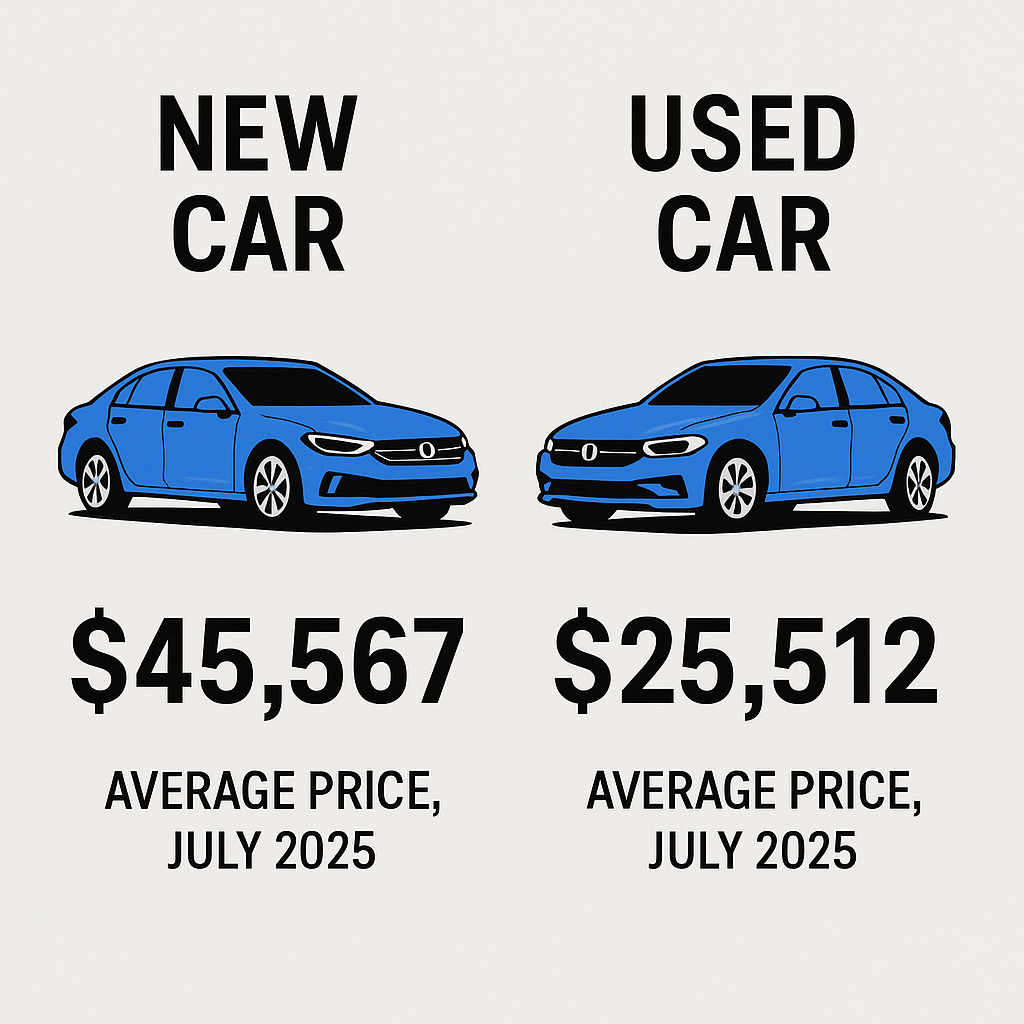

- The average listing price of a used car in July 2025 was about $25,512 — down slightly as summer inventory increases The Washington PostU.S. News Cars+3CarEdge+3Kbb.com+3.

- Meanwhile, Edmunds reports that the average price of a three-year-old used car reached $30,522 in mid‑2025, up 2.3% year-over-year due to tight inventory and high demand The Washington Post+1AP News+1.

- Wholesale prices have dropped for 11 straight weeks, signaling easing heat—but buyers should act while selection is still wide CarEdge.

💳 2. More Buyers Financing (Even for Used Cars)

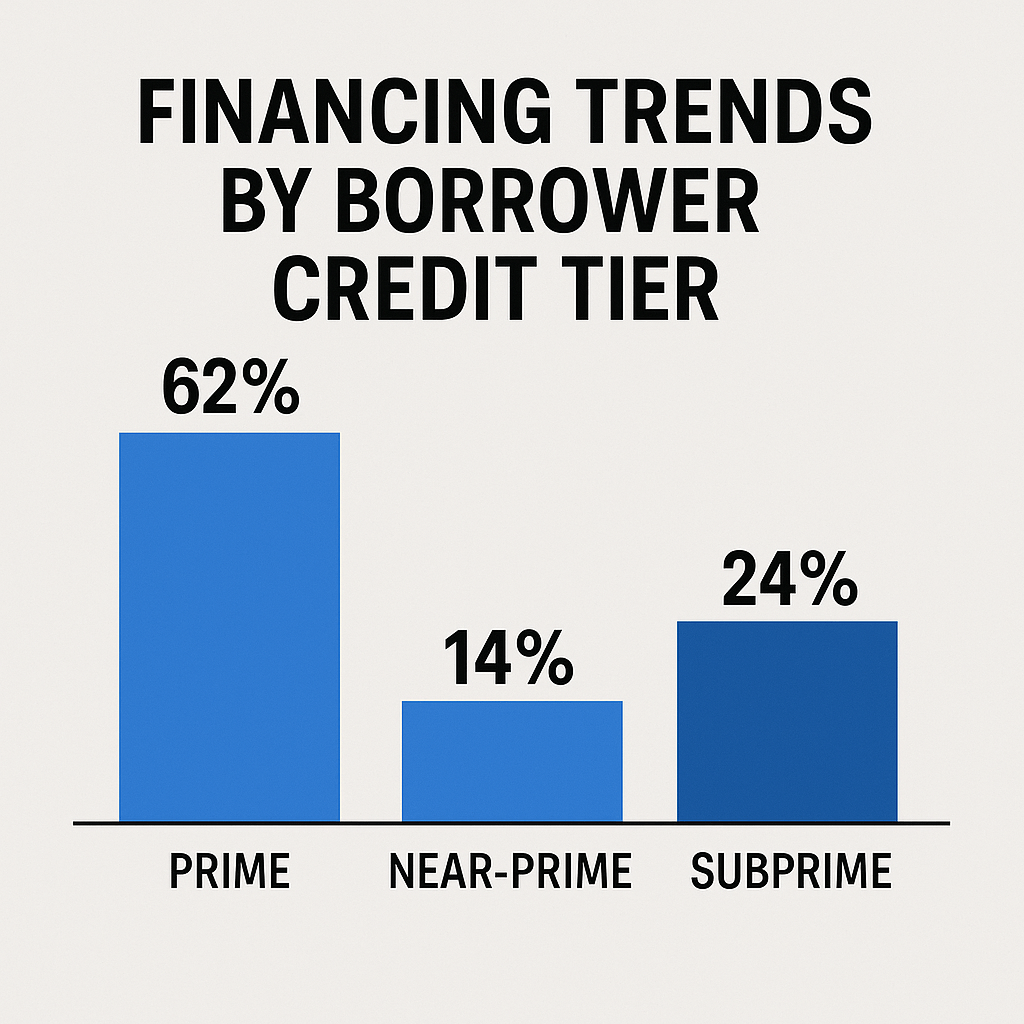

- Over 85% of new vehicles and about 50% of used cars are now financed, not paid in cash bankrate.com+9en.wikipedia.org+9The Washington Post+9.

- The average used car loan rate in early 2025 hovered around 11.6%, compared to about 6.9% for new cars U.S. News Cars+3bankrate.com+3coxautoinc.com+3.

- Despite rising rates, approximately 52% of dealers’ used-car inventory comes from trade-ins—and that volume is rising alongside new car sales AP News+3Barron’s+3cbtnews.com+3.

📅 3. Buyer Behavior Trends in Q2 2025

- Average new car payments reached $745/month, while used car payments averaged around $521—though that’s up slightly from Q1 2025 lendingtree.com.

- The portion of buyers committing to $1,000+ monthly payments hit 19.3%, while long-term loans (84 months or more) made up 22.4% of new vehicle financing edmunds.com.

- Supply of used cars remains constrained: the average age of traded-in vehicles is around 7.6 years, the highest since 2019 AP News+1marketwatch.com+1.

👥 4. Buyer Profiles & Preferences

- Many shoppers are first-time used car buyers, entering the market cautiously.

- EV and hybrid selections are growing but still modest—composed of about 8–12% of overall sales so far recurrentauto.comKbb.com.

- Demand for certified pre-owned (CPO) cars is strong—driven by buyers seeking warranties and peace of mind with limited supply AP News.

🔍 Major Factors Shaping 2025 Used-Car Buyers

📉 Falling Prices with Caution:

Prices are moderating but still elevated historically. Wholesale declines suggest more opportunity for buyers very soon—but limited inventory may keep selection tight coxautoinc.com.

📌 Financing Is Still Smart:

Financing remains the norm—even for used cars—because it preserves liquidity, helps manage monthly budgets, and builds credit. Rising interest rates are offset by the flexibility and purchasing power financing provides en.wikipedia.orglendingtree.com.

📊 Informed Buyers Are Winning:

Buyers armed with pricing data and market insight—especially on trade-in equity and loan options—are better equipped to negotiate and identify value deals.

✅ Your Takeaway: How to Shop Smarter

- Track prices both online and locally to know where fair value lies.

- Prioritize certified pre‑owned models if you’re looking for reliability and warranty.

- Explore financing, even if you have cash—rates are high, but structured loans often make more sense than you’d expect.

- Be flexible—options and colors vary, so broaden your search area if possible.

🚩 Ready for a Smarter Buying Experience?

At Apple Ford of Lynchburg, I’m here to help you navigate shifting market conditions. I can:

- Show you local pricing trends

- Break down loan options and payments

- Compare trade-in evaluations

- Help decide whether buying new, used, or CPO is best for your needs

📞 Call/Text: 434-423-0235

📧 Email: jgrove@applefordva.com

🌐 Visit: applefordva.com

Is there something you would like me to write about? Let me know.

Leave a comment