For years, people have believed that paying cash for a car was the smartest financial move. After all, if you don’t have a monthly payment, you’re saving money — right?

Not always. In today’s financial world, the math can actually work out in your favor if you choose a car loan instead of paying in full with cash. Here’s why.

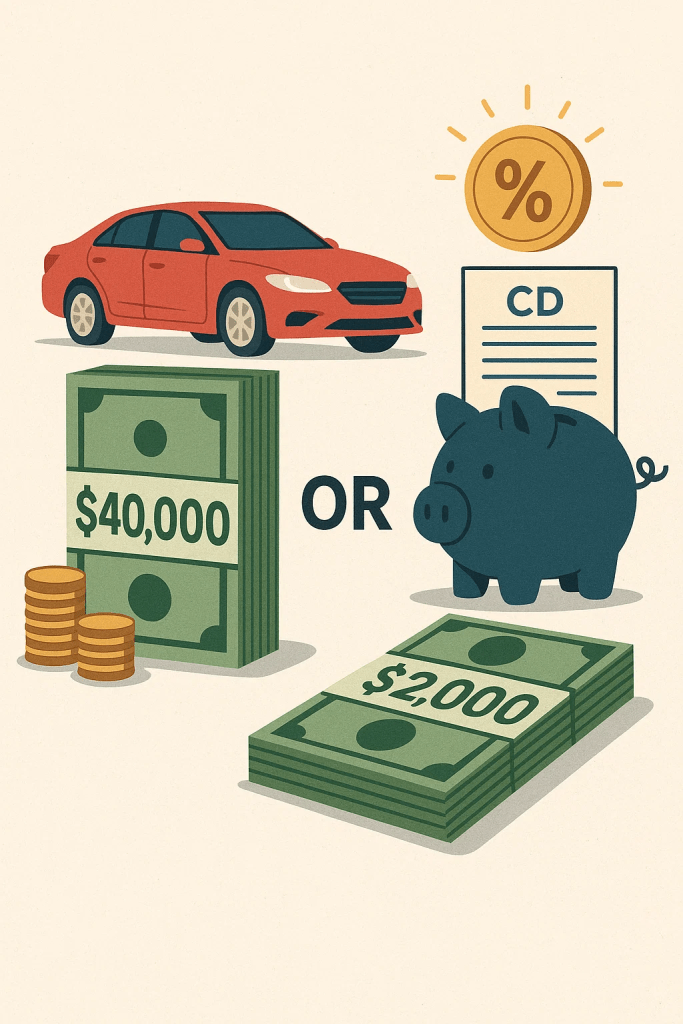

1. Opportunity Cost of Cash

When you pay cash, you’re tying up a big chunk of your money into a depreciating asset — your car. That’s money that could have been earning interest or growing elsewhere.

For example:

- Let’s say you have $40,000 in cash.

- You could spend it all on a car, or…

- You could put that $40,000 into a high-yield CD or savings account at 5%.

- That earns you $2,000 in interest per year.

Now compare that to a car loan: if your interest rate is 4% or lower, the cash in your CD is earning more than you’re paying on the loan. That’s a win for you.

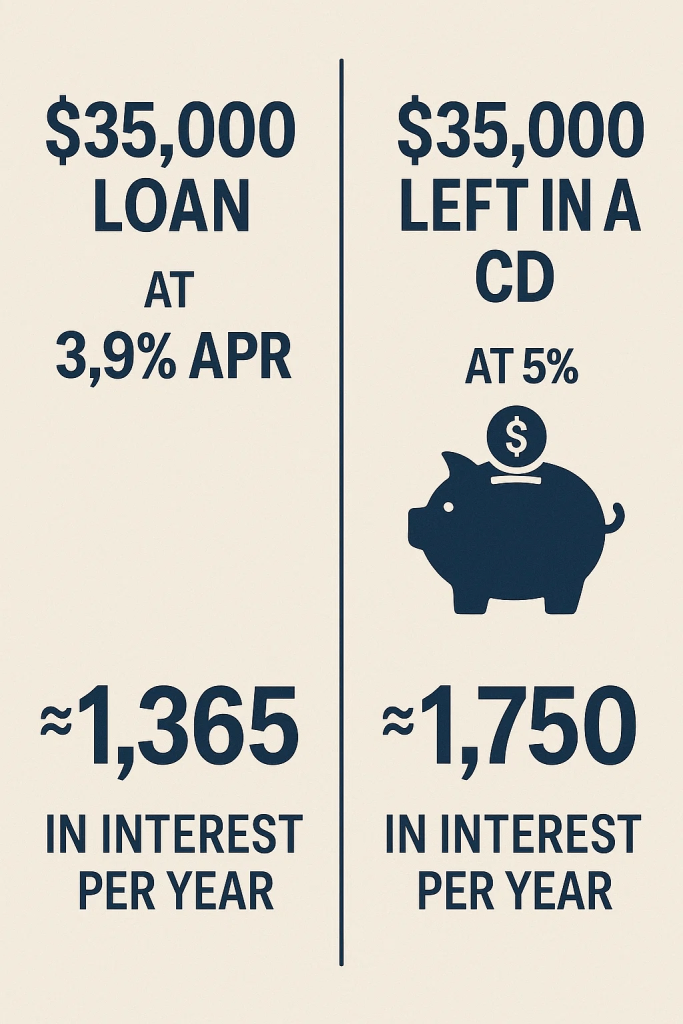

2. Low Interest Rates = Cheap Money

Right now, many lenders and manufacturers offer competitive financing rates, especially for well-qualified buyers. In some cases, those rates are below what you can earn in a safe investment.

Example:

- $35,000 loan at 3.9% APR = about $1,365 in interest per year.

- $35,000 left in a 5% CD = about $1,750 in interest per year.

✅ You’re actually ahead $385 by financing.

3. Building & Protecting Credit

Taking a car loan and making on-time payments strengthens your credit history and score. Even if you could pay cash, financing keeps your credit active — and that can help you later when you’re applying for a mortgage, business loan, or even your next car.

Quick stat: According to Experian, auto loans make up 32% of Americans’ credit mix, playing a key role in building strong credit profiles.

4. Flexibility & Liquidity

Life happens. Emergencies, opportunities, or unexpected expenses can pop up. If you tie up your cash in a car, it’s gone — and you can’t just “withdraw” it again.

By financing, you keep your money liquid and ready to work for you.

5. Cash Isn’t Always King in Deal-Making

Many people assume walking in with a briefcase of cash will unlock huge discounts. In reality, dealerships and manufacturers often prefer financing deals — because it helps them move more vehicles and access lender incentives.

That means you may actually have more negotiating power when financing than when paying cash.

When Does Paying Cash Make Sense?

- If you have excess savings beyond your emergency fund.

- If loan interest rates are higher than investment returns.

- If you simply prefer the peace of mind of owning your car outright.

The Bottom Line

Car loans aren’t just a necessary evil — they can be a smart financial tool. By keeping your cash invested and taking advantage of today’s low interest rates, you may actually save money over time.

Before you empty your savings account for that new ride, run the numbers. If you’d like help comparing your financing options, I’d be happy to walk you through it — and help you make the choice that saves you the most.

Leave a comment